What is book-keeping?

We often see, or rather hear, people use the terms book-keeping and accounting interchangeably. But is doing so the right thing to do?

Well, definitely not. To an untrained eye the two terms may seem interchangeable, or even the same. And while both these functions/ operation deal with the financial aspects of a business or individual, there still is a clear distinction between the two.

In simple terms, book keeping concerns with the record keeping aspect of finances and financial transactions. Accounting on the other hand covers the analysis, classification, interpretation, summarization, and strategizing aspects of finances. Irrespectively however, both of these functions are extremely important for a business/ organization. Let’s look at both of these functions in a little more detail, first independently. After which we will move onto draw a proper comparison between the two.

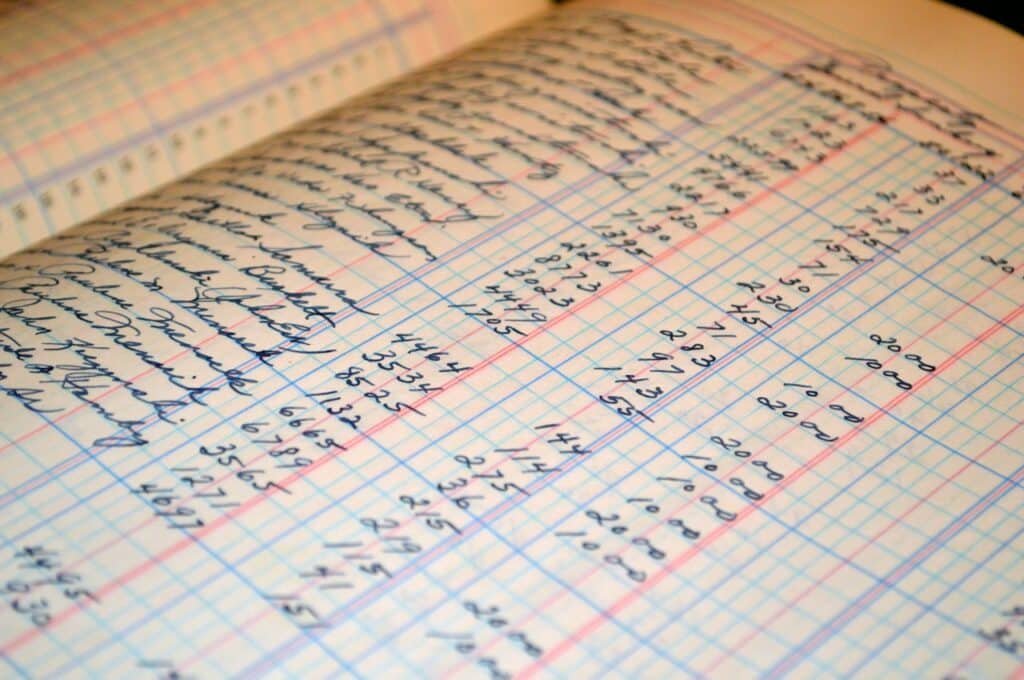

To begin with, a book-keeper is a professional who accurately records all the financial data regarding a business/ organization, in proper detail. Book keeping hence is the act of recording financial data or financial transactions.

The purpose of book-keeping is to ensure that there is a clean, proper and complete log of all financial transactions in regards to the business/ organization. This log or record further facilitates the job of an accountant. In this sense, book-keeping can be considered a pre-cursor to accounting.

What is accounting?

An accountant is a professional who accesses the books (financial records) of an organization. He analyses them, draws inferences, and produces tax returns and other strategies while in keeping with the law.

Accounting consequently is the process of accessing, measuring, summarizing, and interpreting the financial information of an organization. Sometimes an accountant may also be responsible for keeping records, that is, accountants can perform book-keeping function. But the same cannot necessarily be said about a book-keeper.

Top differences between book-keeping and accounting:

The above-mentioned definitions or summaries of the two functions give a broad view of how book-keeping and accounting differ. Now let’s proceed to draw formal differences between the two:

1. Definition

By definition, book-keeping deals with only the identification and recording of various financial transactions performed by the respective business or organization.

Accounting on the other hand, by definition, deals with summarizing the records bookkeepers prepare. It also deals with interpreting these records, drawing inferences and communicating them with the management.

2. Decision-Making Support

Even though the function of book-keeping is extremely essential to a business organization. The information recorded by book-keepers, independently cannot help management make any critical decisions about the business.

On the other hand, an accountant processes these transaction records and prepares their own data. And the management does use the said data to make critical business decisions.

In simple terms, bookkeepers do not directly drive critical business decision making, while accountants do.

3. Educational Requirements

Another important difference between the two job profiles is the educational requirements to become eligible for the job. In most cases, having a high school diploma and some knowledge of advanced mathematics will be enough for a book-keeping position.

However, a person can apply for a certification from the National Bookkeepers Association. Or obtain a license for Certified Public Booking from the National Association of Certified Public Bookkeepers. Though neither is usually a pre-requisite to getting a job as a bookkeeper.

Accountants on the other hand, must have at least a bachelor’s degree in science of accountancy (or related field) to get even an entry-level position. Some states even mandate having a bachelor’s degree for appearing in the CPA exams.

As the level of seniority in accountancy jobs increases, so does the requirement for education, specializations, and certifications. For example, CPA, CFA, CMA, master’s degree etc. And even then accountants usually need to keep studying to stay up-to-date with the latest laws and practices.

4. Skills Required

Again, as is evident, the skills required for book-keeping are much more basic in comparison to those for accounting. In general, book-keeping does not call for special skills. However, bookkeepers must be skilled in mathematics and arithmetic. They also must be highly organized, and have a keen eye for detail to avoid mistakes while recording ledgers.

Being an accountant on the other hand calls for the individual to possess special skills given the analytic and complex aspect of the job. These skills include but are not limited to:

- Systematic analysis

- Critical thinking

- Accurate deliberation

- Knowledge of various computer programs and systems

- Credit, asset, business etc. management knowledge

- Proficiency in accounting processes

- Forecasting skills and many more.

This is also why there are a variety of specialization certifications available for accountants.

5. Objective

The main objective of the two functions- book-keeping and accountancy, differs greatly.

To begin with, the main purpose or objective of book-keeping is only to ensure that all of the financial transactions carried out within the organization are accurately classified and recorded. In other words, the objective is to maintain clear chronological records of the financial activities of the organization.

In contrast, accountancy isn’t as concerned about each and every single transaction. The objective of an accountant is to determine the overall financial health and soundness of the business organization. And to ensure that the business is meeting all of the legal requirements and following the best practices. An accountant must focus on the analysis of the financial situation of the business. And convey the inferences to the management with the goal to help make decisions that are in the best interest of the business.

6. Scope

Just as the objectives of the two job functions differ, so does the scope of each profile type. The difference between the scope of these two jobs stems from the difference between their objectives and the duties/ responsibilities involved.

So, in a single sentence- the scope of the job, of a bookkeeper is smaller and more limited in comparison to that of an accountant.

A bookkeeper has limited responsibilities and hence the requirement of book-keepers as a profile is limited. Not all industries and individuals employ bookkeepers.

An accountant in comparison is to perfume a wide variety of tasks. He is also required to have a wide array of skills and better qualifications. This is why the scope of the jobs in accountancy is bigger. Individuals, as well as organizations of varied sizes, have a requirement for an accountant.

7. Duties and Responsibilities

As mentioned in the point above, the duties and responsibilities to be met by an accountant are different and more complex, than those of a bookkeeper. Let’s have a look at how this is so.

The duties/ responsibilities under book-keeping are generally:

- Recording, maintaining, and processing the payroll.

- Issuing and processing client/ customer invoices.

- Processing other receipts, payments and all other financial transactions.

- Processing the expense claims as they come due.

- Recoding all of the day-to-day business transactions.

- Management and maintenance of financial files and documents.

- Managing the accounts receivables and payables.

- Collecting sales tax. And forward it to respective authorities.

- Maintaining the set petty cash.

- Ensure that the annual budget is being maintained.

- Perform other clerical and support tasks, as and when need be.

In contrast, the duties/ responsibilities to be met by an accountant include (but are not limited to):

- Overseeing the bookkeepers and other financial staff if needed.

- Accurately reading and then interpreting the financial records/ ledger.

- Preparing the adjustment entries as needed.

- Make sure that the organization is complying with all the state as well as federal laws and regulations.

- Preparing all required financial statements and subsequent reports.

- Providing competent financial advice to management/ higher officials based on analysis and inferences drawn.

- Calculating as well as preparing the tax return due. Also in doing so, the accountant is responsible for finding legal ways to minimize the tax burden on the business.

- Preparing reports for and presenting them to stakeholders/ proprietors.

- Setting up a framework to ensure protection against fraud and embezzlement.

As you can see, the two functions may seem similar from a bird’s eye view, but they’re definitely are some major differences between the two.

8. Types of Accounting and Book-keeping

Now, the last yet important difference between book-keeping and accounting comes from the types of processes.

As far as bookkeeping is concerned there are only two types of processes- single entry and double entry. As the name suggests, the single entry system calls for recording each transaction only once. The double entry system on the other hand calls for recording each transaction twice. That is, one record for the account that is being credited, and another record for the account that is being debited.

In contrast to book-keeping, accountancy covers a much larger variety of processes and has many types. These include, but are not limited to:

- Accountants and CPAs

- Auditing

- Forensic accounting

- Tax accounting

- Management accounting

- Cost accounting

- Investment accounting

- Staff accounting, and more.

So, these are the 8 most important differences between accountancy and bookkeeping that you should know. It is also interesting to note here that while accounting as a field of study and career outlook seems to be growing. Book-keeping in contrast seems to be moving towards becoming obsolete. Many experts believe that over time, many book-keeping subfunctions have lost importance and have become unnecessary. And evidently, with technological advancement, many new software and applications have taken over the job of bookkeepers.